Business Debt Protection

Nothing can cripple, or even sink, a business faster than the inability to pay loan instalments, tax bills, rent, salaries and suppliers.Business debt could be to:

- Banks / lenders

- IRD (tax bills or arrears)

- Landlord

- Staff (outstanding holiday pay etc)

- Creditors

- Suppliers

What are your obligations

If you are a sole trader or a member of a partnership, you are personally liable to an unlimited extent for obligations (including loans) incurred in the normal course of business. Should you die or become disabled, your personal assets such as your family home, could be placed at risk by a demand for repayment of a business loan.

If your business is a limited liability company, a bank or lender will often require the directors/shareholders to personally guarantee the borrowings or loan, even though the commercial borrowings are made by the company.

This enables the lender to bypass the limited liability the company would usually otherwise provide and have recourse to the unlimited liability of the guarantor’s assets if required. In addition, the lender’s standard form documentation may create a greater degree of liability for the guarantor than he or she originally anticipated. Where the guarantors are jointly and severally responsible for total debt, the lender may recover the full outstanding balance from any one guarantor.

If you are properly covered against such an eventuality, your share of business debt can be promptly settled and any business liability extinguished.

What are the outcomes of protecting debt?

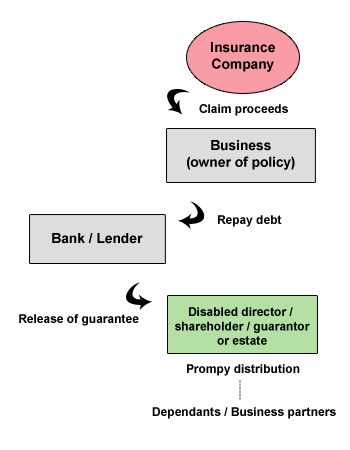

In the event of the death or disablement of a business principal or loan guarantor, the claim proceeds of Debt Protection Cover will:

- Enable repayment of business debt, thereby reducing or eliminating debt-servicing costs.

- Reduce the risk of company and personal insolvency as funds will be available to service any personal guarantees.

- Ensure the business meets its solvency obligations as part of the Companies Act 1993.

As part of the Companies Act 1993, a company must be able to pass the Solvency Test immediately after a distribution is made.Directors can be personally liable if they “cause or allow the business of the company to be carried on in a manner likely to create a substantial risk of serious loss to company creditors” section 135 Companies Act 1993.

What is the Solvency Test?

Liquidity Limb – the Company must be able to pay its debts as they fall due in the ordinary course of business.

Balance Sheet Limb – the Company has assets greater than all its liabilities including contingent liabilities.

In the event of a claim

DISCLAIMER: AIA New Zealand has made all reasonable efforts to ensure that the information in this guide is correct as at the date of printing. This guide is provided by way of general information only and is not to be relied upon as a substitute for obtaining professional advice on the specific circumstances of the individual or business.